Assets Finance Loan Management

Department:

Industry:

Version: 1.0.0

Vendor: iDesign Solution

Assets Finance Loan Management เป็นระบบการบริหารจัดการการให้สินเชื่อแก่ผู้ประกอบการรายย่อยโดยการขายฝากอสังหาริมทรัพย์ เช่น ที่ดิน บ้าน คอนโด แบบครบวงจร ซึ่งประกอบด้วย การกำหนดเงื่อนไขผลิตภัณฑ์, การพิจารณาอนุมัติและประเมินอสังหาริมทรัพย์, การพิจารณาอนุมัติและกำหนดวงเงินสินเชื่อ, การเบิกเงินกู้และการจดจำนอง, การจ่ายคืนเงินกู้, การปิดบัญชีเงินกู้ และการบริหารจัดการหนี้

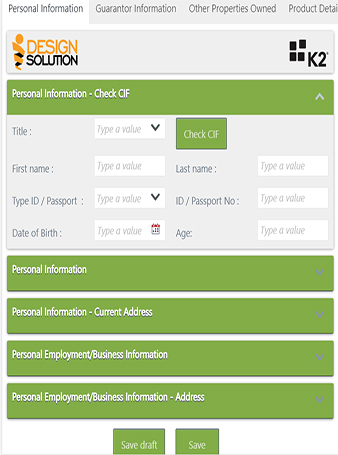

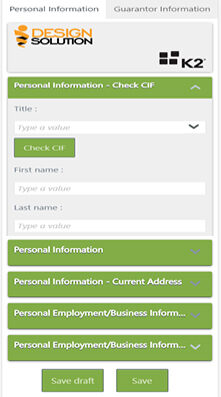

FORMS

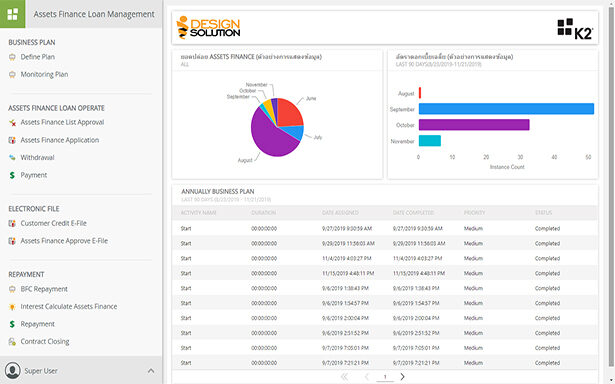

- Dashboard Performance

- Assets Finance Loan Criteria & Condition Set up

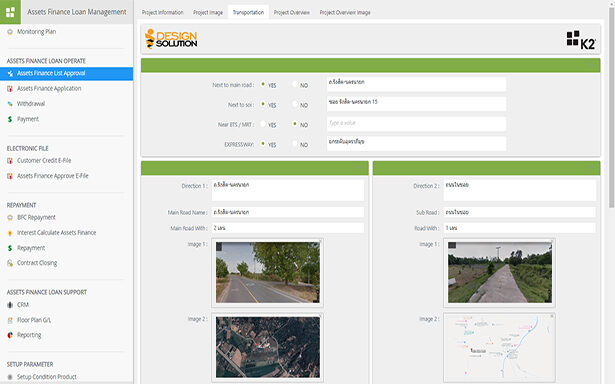

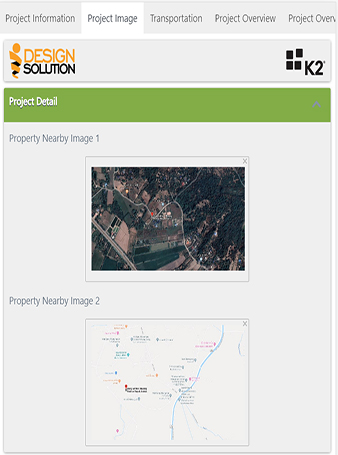

- Property Inspection & Approval

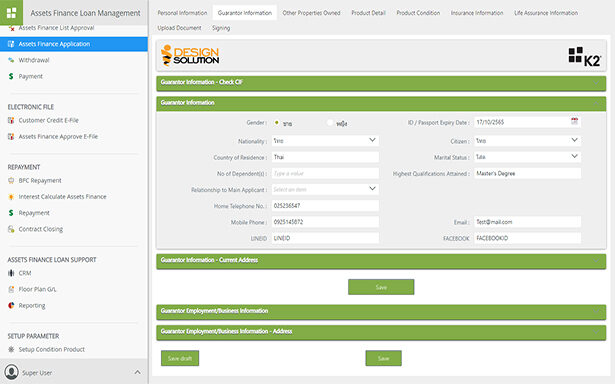

- Credit & Credit Line Approval

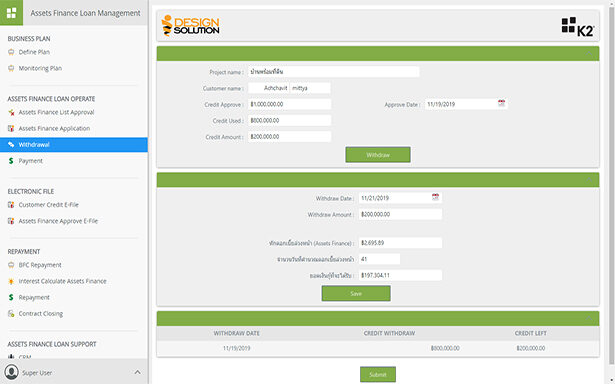

- Credit Line Withdrawal & Mortgage Operate

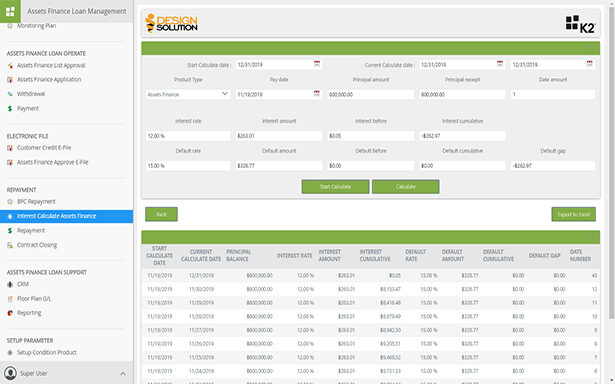

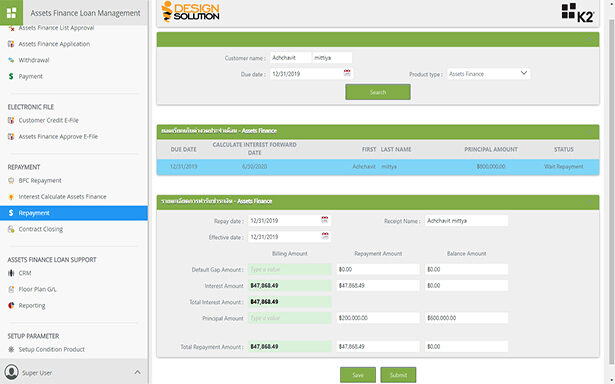

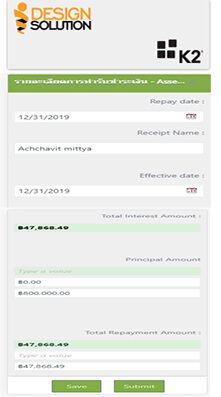

- Loan Repayment

- Loan Closing

- Debt Management

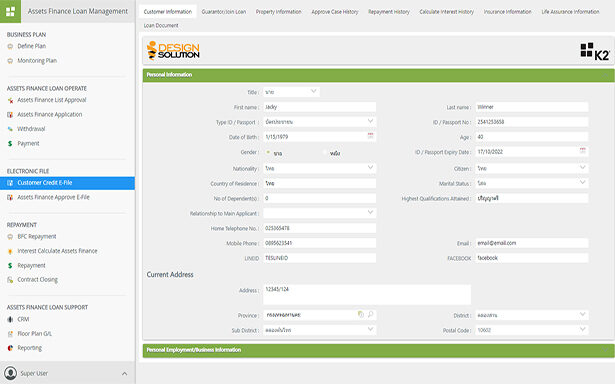

- Customer Electronic Files

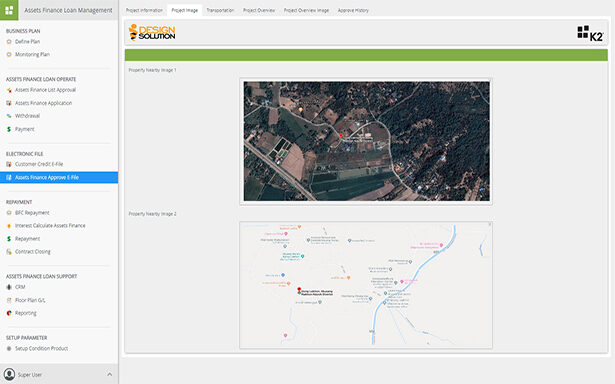

- Property Electronic Files

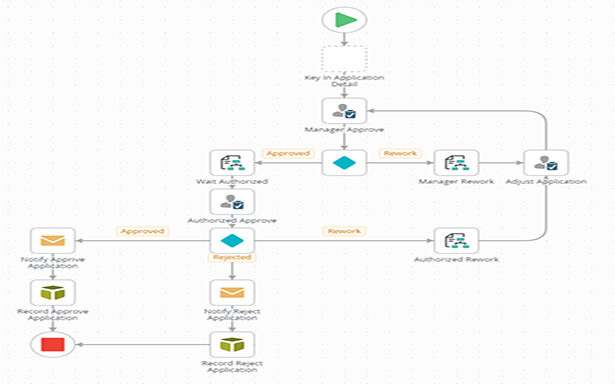

FLOWS

- Assets Finance Loan Criteria & Condition Set up

- Property Inspection & Approval

- Credit & Credit Line Approval

- Credit Line Withdrawal & Mortgage Operate

- Loan Repayment

- Loan Closing

- Debt Management

REPORTS

- Standard Dashboard

- Property Inspection & Approval Report

- Credit & Credit Line Approval Report

- Credit Line Withdrawal & Mortgage Operate Report

- Loan Repayment Report

- Loan Closing Report

- Debt Management Report

BUSINESS BENEFIT

Management

- Able to measure and evaluate Assets Finance Loan Business with statistical data from the system

- Able to analyze and design products directly to target groups and is fast to the needs of the market

Product / Marketing / Sales

- Able to support and respond to the needs of every group of customers in all aspects and in a short time

- Able to develop new strategies to compete with competitors in the Assets Finance Loan market

Operation Staffs

- Flexible System & Monitoring

- Can set Assets Finance Loan Business rules, condition & operations for each product differently

- Able to control operations with workflow

- Increase efficiency and productivity in each process with workflow tools

- Lean & Reprocess to reduce times used in each process for better serve the customer

- Reduce business operating cost

Customers

- Able to check and update one’s own information

- Able to perform various transactions by oneself at any time

- The company can report various interesting benefits to Customers